Top US LNG Importers Rely on Panama Canal

BLUF

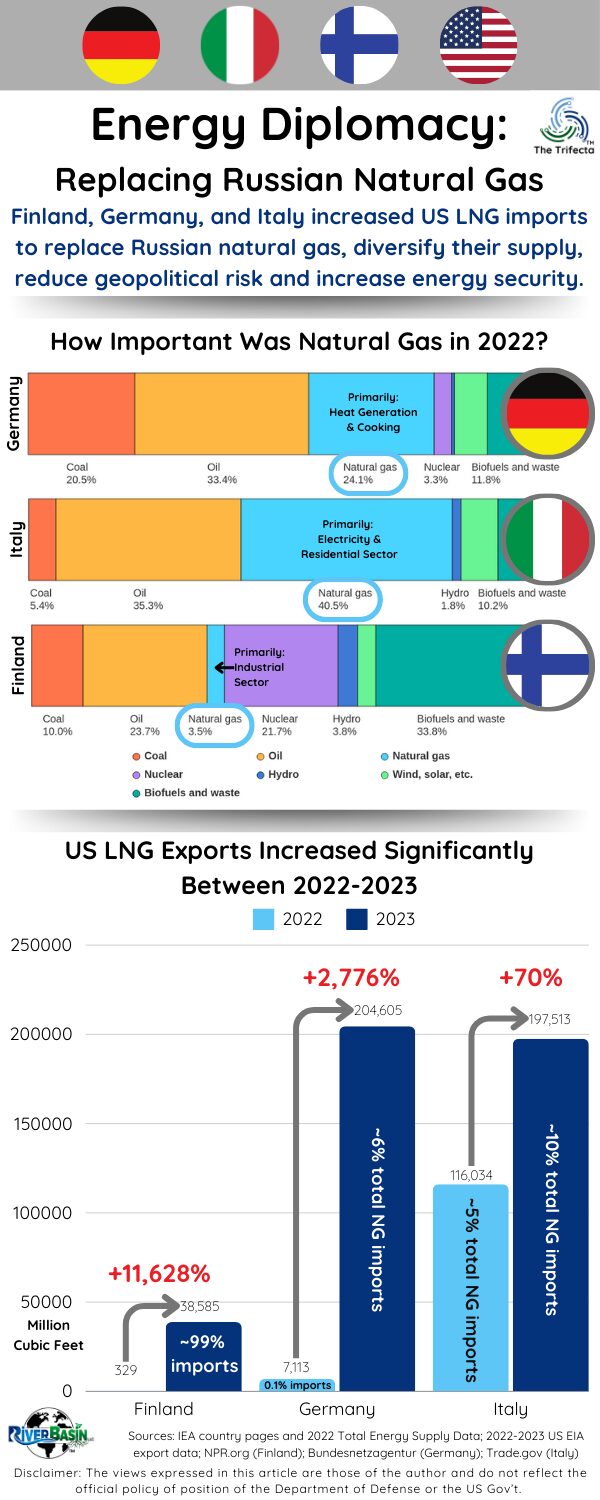

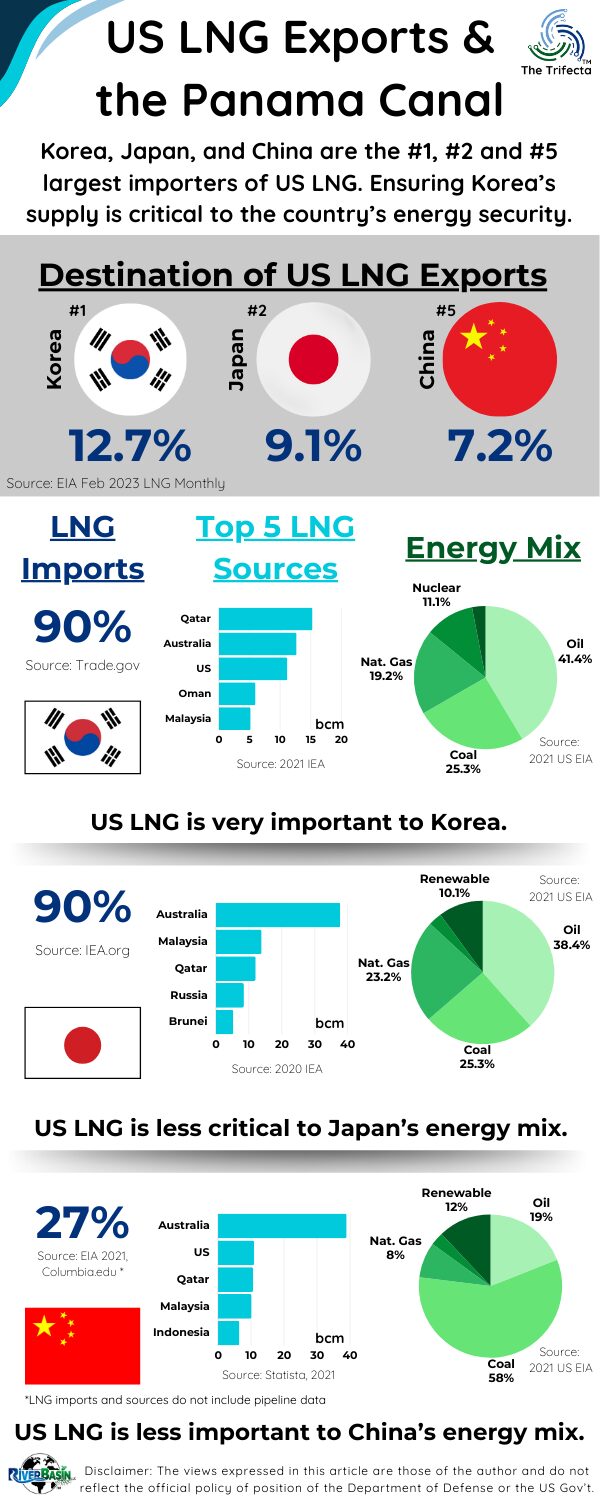

Korea, Japan, and China are the #1, #2 and #5 largest importers of US LNG. Ensuring Korea’s reliable supply of US LNG is critical to the country’s energy security. Japan and China are less reliant on US LNG.

Why does this matter?

All points of exit for US LNG exports are located on the Atlantic side of the Panama Canal. That means exports are required to transit the Canal to reach their Asia destinations. Shipping delays through the canal could have third order affects on the LNG recipients.

Key Take-Aways

- Korea is the most susceptible to unreliable passage of US LNG exports through the Panama Canal.

- LNG is strategically critical to Japan, but the US is the 8th largest supplier.

- US LNG is less important to China’s energy mix, particularly as domestic Chinese production increases.

Disclaimers: The views expressed in this article are those of the author and do not reflect the official policy or position of the Department of Defense or the U.S. Government. The appearance of external hyperlinks does not constitute endorsement by the United States Department of Defense (DoD) of the linked websites. The DoD does not exercise any editorial, security or other control over the information you may find at these locations.

Korea is the most susceptible to unreliable passage of US LNG exports through the Panama Canal.

South Korea lacks a robust domestic energy production capability and imports 97% of its total energy. Of the total energy mix, about 1/5 is LNG, which means disruptions in LNG would be felt by citizens of Korea. The country uses LNG in residences, industries and for power generation.

The US is Korea’s #3 top supplier of LNG. Korea receives more LNG from Qatar and Australia compared to the US. Importing directly from Qatar and Australia avoids Panama Canal delays. However, supplies from both countries would be at risk due to geopolitical reasons, not discussed here. (Teaser: Strait of Hormuz, Strait of Malacca, South China Sea, East China Sea)

LNG is strategically critical to Japan, but the US is only the 8th largest supplier.

Japan was the largest importer of LNG in the world for many years, particularly following closure of all nuclear power plants after the 2011 Great East Japan Earthquake. The reduction in nuclear energy supply caused a surge in demand for LNG imports.

Similar to Korea, Japan imports about 90% of its LNG. This fuel comprised about 1/5 of Japan’s 2021 energy mix, according to US EIA data. LNG is so important to Japan, the country has a “Strategic Buffer LNG” with diversified import sources.

Primary LNG sourcing countries to Japan are Australia, Malaysia, Qatar and Russia, with the US coming in as Japan’s 8th largest supplier. According to the Director of the Energy Resource Development Division of the Ministry of Economy, Trade and Industry, Japan views Qatari LNG as critical and appreciates their supply stability. The top three LNG suppliers to Japan do not rely on shipping through the Panama Canal. From Japan’s perspective, the lower reliability of US LNG to Japan is less critical because the US is only the 8th largest supplier (versus the biggest supplier).

Putin’s 2022 actions affected LNG prices in Japan.

Looking at Russia, recall Russia’s influence of Japanese LNG prices after Putin took over Sakhalin-2 (covered here). This incident may have taught Japan some lessons about reliability of Russia as a supplier moving forward.

Meanwhile, Japanese companies are expanding renewable energy projects in Australia, including e-methane, solar and battery (covered here). In 2022, Australia supplied 30% of Japan’s total energy needs, including two-thirds of Japan’s coal and roughly one-third of Japan’s LNG. The strategic partnership between Japan and Australia indicates how important Australian energy exports (beyond just LNG) are to Japan.

Similar to Korea, supplies from Australia, Malaysia, and Qatar are at risk due to other geopolitical factors not covered here. (Teaser: Strait of Hormuz, Strait of Malacca, South China Sea, East China Sea)

US LNG is less important to China’s energy mix, particularly as domestic Chinese production increases.

Let’s begin with perspective regarding the vast energy consumption differences between Korea, Japan, and China. In 2020, China consumed 145 exajoules, while Japan consumed 17 exajoules and Korea consumed 11.8 exajoules. Their respective energy consumption makes China, Japan, and Korea rank #1, #5 and #10 in the world. China’s energy consumption was over eight times Japan’s. The magnitude of China’s energy consumption is an important counterbalance to the fact that natural gas comprised only 8% of China’s overall energy mix in 2021.

China’s natural gas imports are distinct from Korea and Japan for a notable reason.

China imports natural gas in two different ways – via sea and land. First, seaborne LNG imports comprised two-thirds of China’s total natural gas requirements. Second, China imported about one-third of its natural gas via pipeline, primarily from Turkmenistan and Russia. This secondary import method provides a level of resilience neither Korea nor Japan enjoy.

Overall, China relies on imports for 45% of its total natural gas requirements. Only 27% of the imports LNG via the sea. Primary LNG sourcing countries to China are Australia, the US, and Qatar, with Australia being the clear leader. In 2023, China overtook Japan as the world’s largest LNG importer. This was due to Japan’s efforts to restart nuclear power plants (many shut down after the 2011 Fukushima disaster), which reduced its need for LNG imports.

In the meantime, China continues to pursue aggressive expansion of its domestic natural gas production capability. Energy security via energy independence remains a goal for China, which decreases the effect of Panama Canal delays for US LNG imports.

Think About It…

- Who relies on your company’s energy shipments that are delayed at the Panama Canal?

- How will those delays affect the energy security of the receipt?

- How do you incorporate the recipient/buyer in your LNG ship prioritization efforts?

DOPSR 24-P-0389