BRI’s $1.3T+ of Investment – Beware of Business Risk

BLUF

The PRC’s Belt and Road Initiative (BRI) investments span the globe and could present risk to businesses whose value chains depend on countries with heavy BRI investment. Understanding that interface and potential dependency are the first steps to determining what risk may be present.

Why does this matter?

BRI is a mechanism by which the PRC gains more influence in a country. Depending on Chairman Xi’s goal, leveraging BRI relationships for his benefit could deliberately or inadvertently put foreign business operations at risk.

Key Take-Aways

- State-funded foreign investments like the BRI fall under the “economic” instrument of national power.

- The Belt and Road Initiative (BRI) expands PRC’s global influence.

- Business risk may increase by relying on countries in which the PRC has influence via BRI.

Disclaimers: The views expressed in this article are those of the author and do not reflect the official policy or position of the Department of Defense or the U.S. Government. The appearance of external hyperlinks does not constitute endorsement by the United States Department of Defense (DoD) of the linked websites. The DoD does not exercise any editorial, security or other control over the information you may find at these locations.

State-funded foreign investments like the BRI fall under the “economic” instrument of power.

We previously looked at the national instruments of power. As the name implies, the economic instrument of power leverages economic means to promote a country’s interests or exert influence. Examples of economic influence include trade policies, foreign aid, investments, or sanctions. Foreign aid and investments are at the forefront of our attention in this article.

In the rules-based international system, significant economic aid is provided via United Nations-affiliated organizations, such as The World Bank and The International Monetary Fund (IMF). Funding from these organizations differs from a country wielding their economic instrument of power.

The Difference Between Foreign “Aid” and “Investment” and Where BRI Fits in

The terms “foreign aid” and “foreign assistance” are used interchangeably and have the same meaning.

A well-known example of US economic foreign aid was the Marshall Plan following World War II. The Economic Recovery Act of 1948 was the official name of the Marshall Plan. This significant and enduring economic aid from the United States helped rebuild post-war Europe.

In 1961, Congress passed the Foreign Assistance Act, which led to a consolidation of foreign assistance organizations and programs. The US Agency for International Development (USAID) was created shortly after and is a leader of providing foreign aid around the world. A key component of USAID foreign aid is it is given freely without reciprocation. Foreign aid from multiple US government organizations can be viewed on this interactive website.

In contrast to foreign aid, foreign investment comes with the expectation of a return. The “return” may be as profits or it may manifest itself as influence by the “investing country” in the receiving country. Innumerable forms of influence could be desired.

In this article, we will focus on political influence gained via foreign investment. To be clear, many countries engage in this behavior, including the US. The BRI is notable because it is relatively new (compared to US investment, for example) and is extensive.

The Belt and Road Initiative (BRI) expands PRC’s global influence.

The cornerstone of Chairman Xi’s foreign policy is the Belt and Road Initiative (BRI). First announced in 2013, the name has changed multiple times and the effort is still referred to by different names. Common examples are BRI, One Belt One Road, or the New Silk Road.

The official BRI site can be found here.

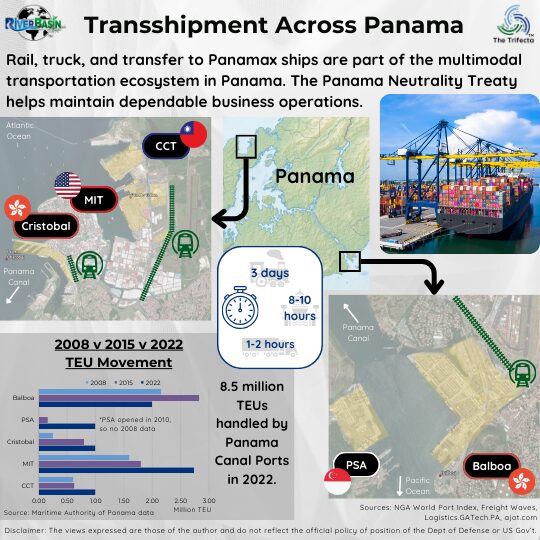

At a high level, the BRI spans the globe and intends to bolster connection for land and sea trade routes. For example, the “New Silk Road” moniker refers to the historic silk road, evoking an appropriate sense of expansiveness for the PRC’s endeavor. According to Congressional testimony from May 2024, over 21,000 BRI projects in 165 countries are worth at least USD$1.34 trillion. These investments greatly extend the PRC’s influence around the world.

Many views on the BRI exist, with dynamics differing by country. Only about 10% of the funding is via aid, meaning no repayment is expected. The other ~90% of funding is via investments in various industrial sectors. There is a heavy component of construction and infrastructure projects. Many projects focus on natural resources, which the PRC needs to support continued economic growth in China.

For Chairman Xi, the BRI serves multiple purposes.

From a DIME perspective (diplomatic, information, military, economic), BRI directly relates to the diplomatic, information and economic instruments of power. It is a tool for diplomacy with each participant country. BRI is a way to increase positive perception of the PRC’s world engagement. It also provides economic resources to developing countries that need it. Beyond these external-focused goals, BRI supports goals internal to China, such as the economic growth mentioned above.

Several organizations follow or analyze BRI investments. Some examples include: Green Finance & Development Center, Aid Data, American Enterprise Institute, CSIS, and Council on Foreign Relations.

Businesses risk may increase by relying on countries in which the PRC has influence via BRI.

We already have examples of ways the PRC leverages BRI relationships for their benefit. Beyond the advantages expected from a donor country, these benefits extend to supporting the PRC’s strategic political goals. Three examples provided in the same Congressional testimony referenced above include:

- Withholding of aid from countries that recognize Taiwan.

- Using aid to secure policy concessions from foreign leaders.

- Buying UN votes with aid.

So, while the BRI investments can bring a lot of benefits to recipient countries, there may be associated risks for businesses operating in the recipient country. The PRC acts in its best interest and is using BRI to gain influence around the world. If needed, it is not a stretch to think Chairman Xi would consider what influence options he has via BRI investments. These options are additional levers he could try to pull to achieve a desired outcome.

Businesses will probably interface with the BRI because of its global engagement. Understanding that interface and potential dependency are the first steps to determining what risk may be present.

Think About It…

- With which BRI countries does your company work?

- How do BRI projects support your value chains today?

- Is your company invested in any BRI projects with the PRC?

- Where do your value chains interface with BRI investments?

Not sure how your business interfaces with BRI or how to evaluate the associated risk? Contact River Basin for help.

DOPSR 24-P-0729