Energy Diplomacy: Replacing Russian LNG

BLUF

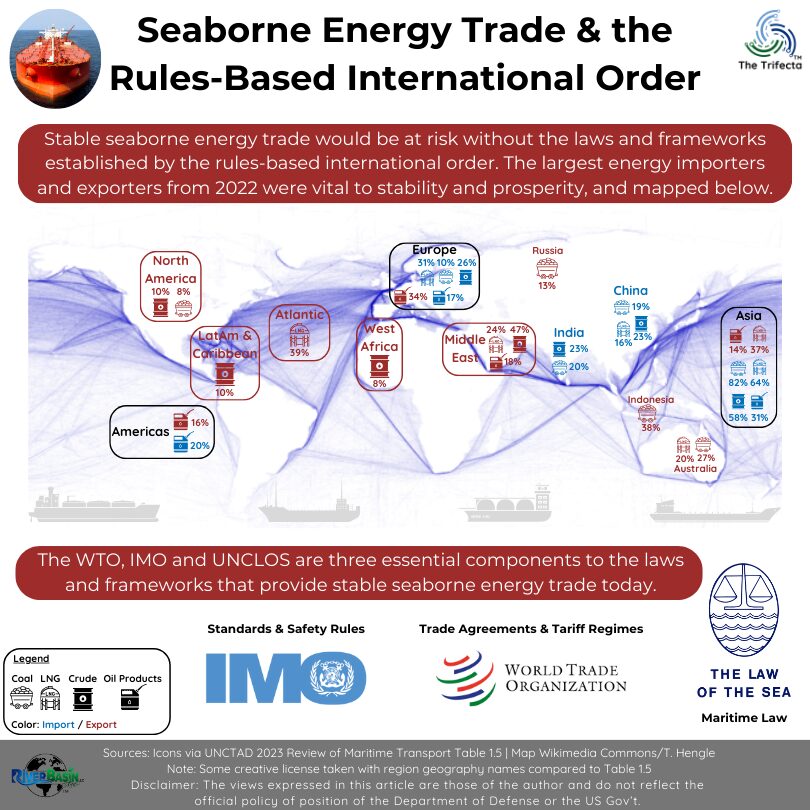

Finland, Germany, and Italy increased US LNG imports to replace Russian natural gas, diversify their supply, reduce geopolitical risk, and increase energy security.

Why does this matter?

It’s about energy security, not energy independence. Energy diplomacy via US LNG exports to European allies provides many benefits for both parties.

Key Take-Aways

- Putin weaponized natural gas supply, highlighting the geopolitical risk of relying on a dictator for LNG.

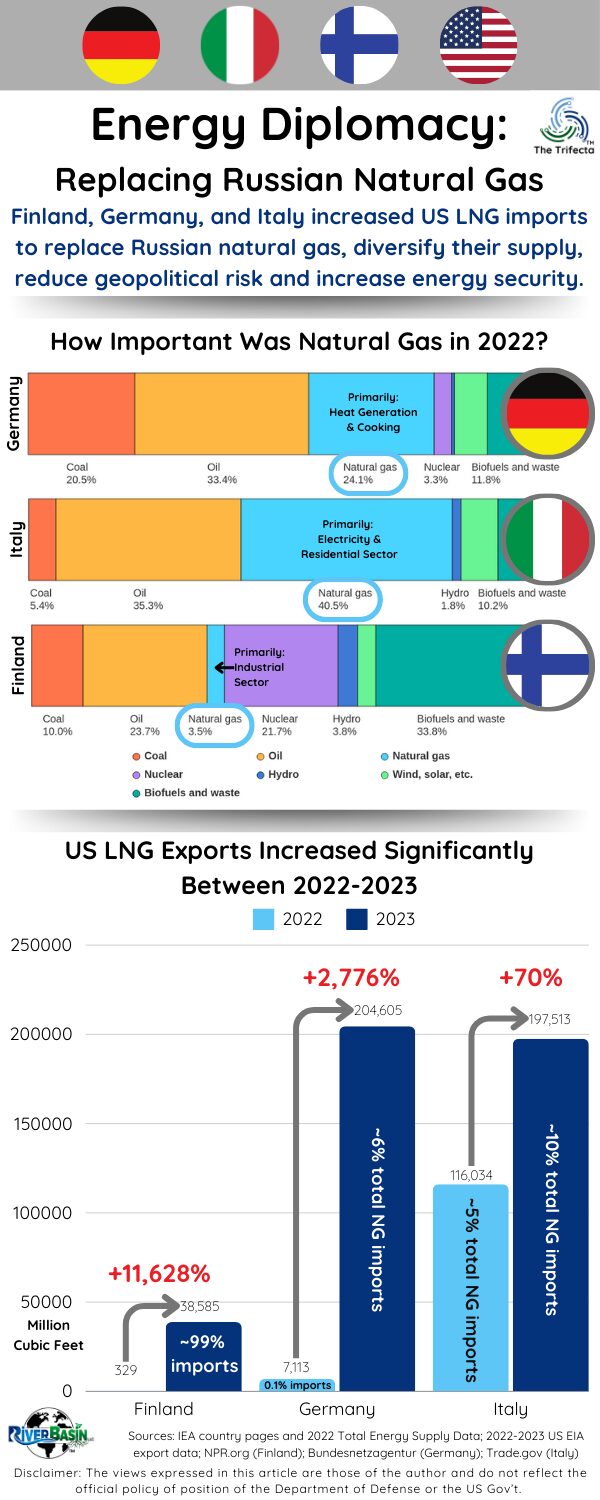

- Compared to 2022, Finland, Germany, and Italy increased their US LNG imports in 2023 by 11,628%, 2,776% and 70%, respectively. Each country has a different story.

- Energy diplomacy across the Atlantic helps strengthen diplomatic ties, promotes economic cooperation, and enhances energy security.

Disclaimers: The views expressed in this article are those of the author and do not reflect the official policy or position of the Department of Defense or the U.S. Government. The appearance of external hyperlinks does not constitute endorsement by the United States Department of Defense (DoD) of the linked websites. The DoD does not exercise any editorial, security or other control over the information you may find at these locations.

Putin weaponized natural gas supply, highlighting the geopolitical risk of relying on a dictator for LNG.

Effective April 1, 2022, Putin demanded foreign buyers of Russian natural gas must pay in rubles. Contracts with foreign companies and European countries stipulated payment to be made in Euros or US dollars. He threatened to cut off national gas supplies if buyers did not comply. In this one move, Putin unilaterally changed contract language and threatened severe consequences, with buyers having little recourse.

In May 2022, Russia stopped delivering natural gas to Finland. Nearly all of Finland’s natural gas came from Russia. It has been that way since the 1970s, when the pipelines were built to deliver Soviet natural gas to Finland.

Nord Stream 1 comes up again.

Elsewhere in Europe, the saga of the Nord Stream 1 pipeline is well known to many. Roughly 35% of the European Union’s natural gas came from Russia via Nord Stream 1 via undersea pipeline. In June 2022, Russia reduced Nord Stream 1 exports to 40% capacity and further decreased exports to 20% of capacity in July. Putin blamed maintenance issues with the turbines in July. In August, Nord Stream 1 was shut down entirely. In September, Nord Stream 1 sustained damage ensuring it would remain inoperable. (We’ll skip the Nord Stream 2 portion of the story.)

The net effect for Germany and all of Europe was sudden and unpredictable change to the energy supply. Europe had no inherent ability to mitigate or ease the issue. Putin’s actions directly contravened export contracts established between entities. While we view these types of contracts as legally enforceable, the Finland and Nord Stream 1 saga showed the impotence of the victims. Drama around the Nord Stream 1 pipeline was one of the most poignant and newsworthy of Putin’s affronts to international relations during 2022.

For more geopolitical risk examples perpetrated by Putin, check out this article.

Compared to 2022, Finland, Germany, and Italy increased their US LNG imports in 2023 by 11,628%, 2,776% and 70%, respectively. Each country has a different story.

Each country has a different story. We’ll look at one country at a time.

Finland replaced Russian natural gas with US LNG.

According to the International Energy Agency (IEA), natural gas comprised merely 3.5% of Finland’s total 2022 energy supply. Industries are the major consumers of natural gas, whereas most households do not depend on natural gas for heating (unlike in other areas of Europe).

In 2023, we saw US LNG exports to Finland increase by over 11,000%. Essentially, Finland replaced all the Russia natural gas with US LNG. For example, Finland used 41,845 million cubic feet of natural gas in 2022 (44,149 TJ according to IEA data). In 2023, Finland imported 38,585 million cubic feet of LNG from the US. Since Finland has no domestic natural gas production capability, the country relies on imports.

Part of the logistics infrastructure that supported the supply change was a new floating LNG terminal that Finland urgently chartered for a 10-year period. The floating terminal is owned by a US company, which helps prevent a repeat of Finland’s reliance on infrastructure controlled by an adversary.

Germany increased US LNG as a diversification measure to reduce geopolitical risk and increase energy security.

Germany is a much different story than Finland. Natural gas makes up a larger portion of Germany’s energy mix and is commonly used for heat generation and cooking. In 2021, 76% of the natural gas was used by ultimate consumers, showing how much the German population relied on natural gas. This context helps explain why Russia’s reduction of gas exports presented a crisis in Germany, particularly approaching the 2022-2023 winter.

In 2021, Russia provided 52% of Germany’s natural gas. The next year, that portion fell to 22%, according to the Bundesnetzagentur. In response, imports from Norway increased from 33% (2022) to 43% (2023) of total supply, making Norway the top supplier of natural gas to Germany in 2023. In 2023, overall natural gas imports decreased by nearly a third because of reduced domestic demand and lower exports.

Germany also sought to diversify its energy supplies as an energy security measure. In 2022, LNG imports from the US provided about 2 TWh of energy, which was roughly 0.1% of the total natural gas imports. The following year, imports from the US increased to nearly 60 TWh and just over 6% of the total. This significant increase in US LNG imports was only one part of Germany’s focus on diversifying energy supply and reducing domestic energy demand.

(We’ll keep a tight scope in this article, but there are volumes written on Germany’s energy security journey since Putin invaded Ukraine.)

Italy used US LNG to diversify supply like Germany did.

Like Finland, Italy imports the vast majority of its natural gas (IEA). Unlike Finland, however, natural gas was the single largest source of energy in Italy (41%) and only 4.5% was produced domestically. In 2020, Russia provided 43% of Italy’s natural gas.

Most imports arrived via pipeline (check out the map), but LNG imports increased as a diversification measure following Putin’s Ukraine invasion. In 2022, Italy’s natural gas demand was 68 billion cubic meters (bcm). The same year, US LNG imports provided roughly 3.3 bcm (116,034 MMcf) or just under 5% of the total. The following year, demand dropped to 60.6 bcm, while US LNG imports increased to provide nearly 10% (5.9 bcm or 197,513 MMcf) of Italy’s natural gas.

How does Italy use their natural gas? In Italy, natural gas is essential for electricity generation, accounting for 48%. In terms of ultimate consumers, the residential sector accounts for over 70% of final natural gas consumption. Like Germany, this reliance on natural gas makes gas supply and cost important to Italians.

(Also like Germany, a lot of written on Italy’s energy security journey and is beyond the scope of this article.)

Energy diplomacy across the Atlantic helps strengthen diplomatic ties, promotes economic cooperation, and enhances energy security.

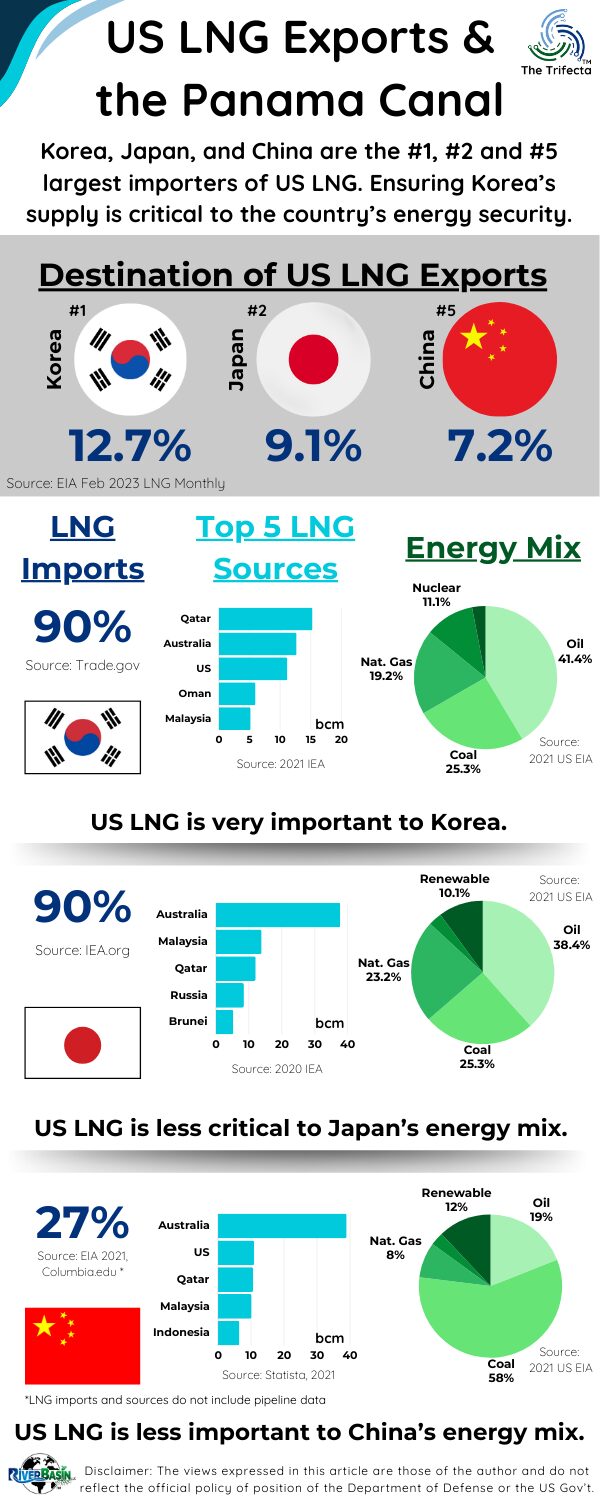

Energy diplomacy through US LNG exports to Europe has been a significant aspect of geopolitical relations since Putin’s invasion of Ukraine in 2022. As discussed above, US LNG supported diversification of energy supply and reduced reliance on Russian gas. This diversification of supply helps mitigate the risk of supply disruptions and price spikes. For European countries, it also provides more leverage in their relations with other energy suppliers.

Energy trade fosters economic interdependence and increases energy market integration between the US and Europe. This integration enhances competition, increases market liquidity, and can lead to more efficient pricing mechanisms. Demand for LNG will probably increase as Europe transitions away from coal and focuses on reducing greenhouse gas emissions. For the US, exporting LNG to Europe diversifies its export markets and reduces reliance on any single region.

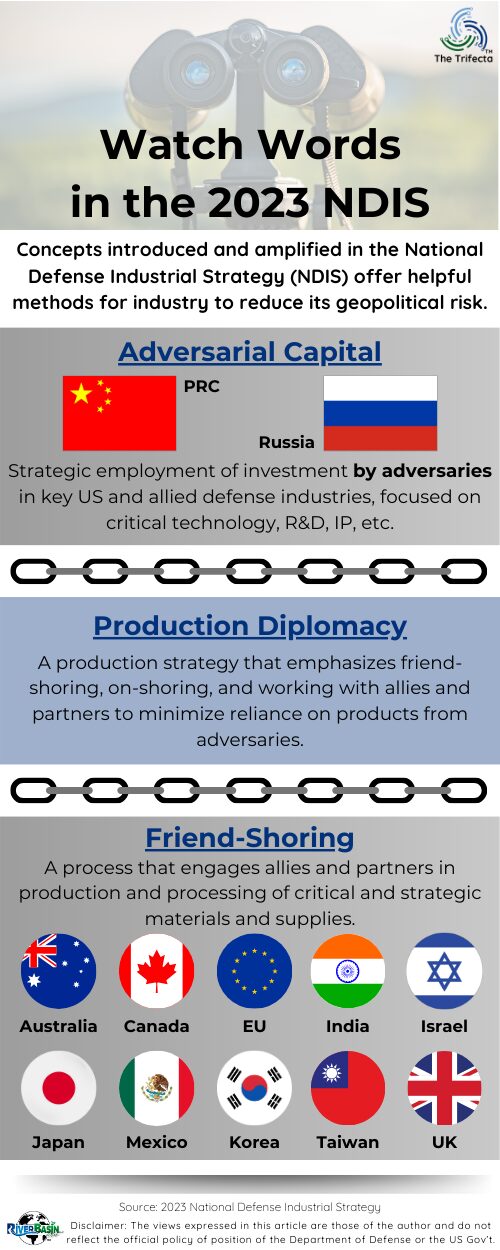

Energy trade can serve as a cornerstone for broader diplomatic cooperation on various issues. It is aligned with friend-shoring, which we discussed in previous posts (Watch Words and Democracy Index). Overall, US LNG exports to Finland, Germany, and Italy helped bolster the energy security of those countries.

Energy security is closely intertwined with national security considerations, as it affects economic stability, geopolitical relations, infrastructure protection, resilience to disasters, environmental sustainability, and technological innovation.

DOPSR 24-P-0651

Think About It…

- How do your company’s exports support energy diplomacy?

- When Putin invaded Ukraine, what operational changes happened within your company?

- Who at your company considers the energy diplomacy aspects of strategic decisions?

- What export products in your company rely on very few customers or are confined in a single region?

- What role does your company play in energy security?