What Supports Seaborne Energy Trade?

BLUF

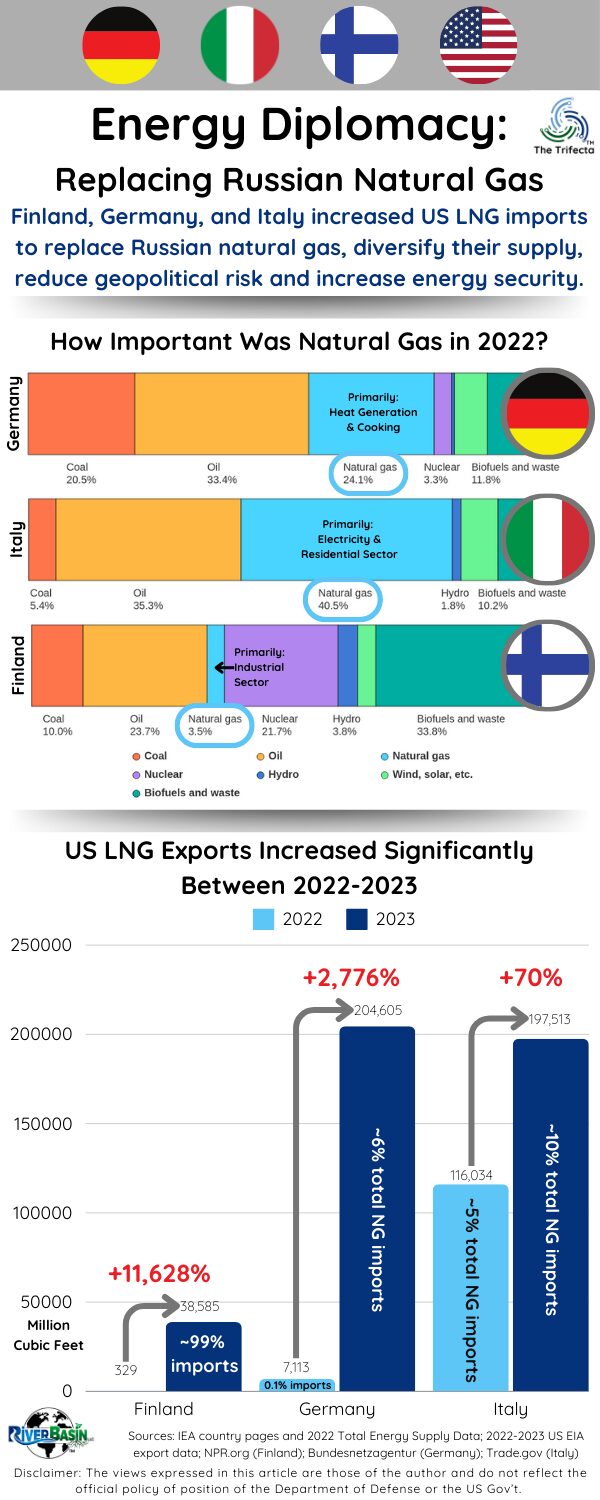

Stable seaborne energy trade would be at risk without the laws and frameworks established by the rules-based international order. The largest energy importers and exporters from 2022 were vital to stability and prosperity (see map). Their global reach reinforces the need to maintain stable sea lanes.

Why does this matter?

While engrossed in our daily lives, it’s easy to forget how connected everything is. Seaborne energy trade is indispensable for global energy security, economic prosperity, and geopolitical stability, underscoring its enduring importance in the contemporary world order.

Key Take-Aways

- Seaborne energy trade flourished because of the legal and institutional framework provided by the rules-based international order.

- Developing economies in Asia, with 60% of the world’s population, depend on seaborne energy imports.

- Seaborne energy exporters around the world enable importers to access diverse energy sources, help mitigate supply disruptions, and optimize their energy mix to meet domestic needs.

Disclaimers: The views expressed in this article are those of the author and do not reflect the official policy or position of the Department of Defense or the U.S. Government. The appearance of external hyperlinks does not constitute endorsement by the United States Department of Defense (DoD) of the linked websites. The DoD does not exercise any editorial, security or other control over the information you may find at these locations.

Seaborne energy trade flourished because of the legal and institutional framework provided by the rules-based international order.

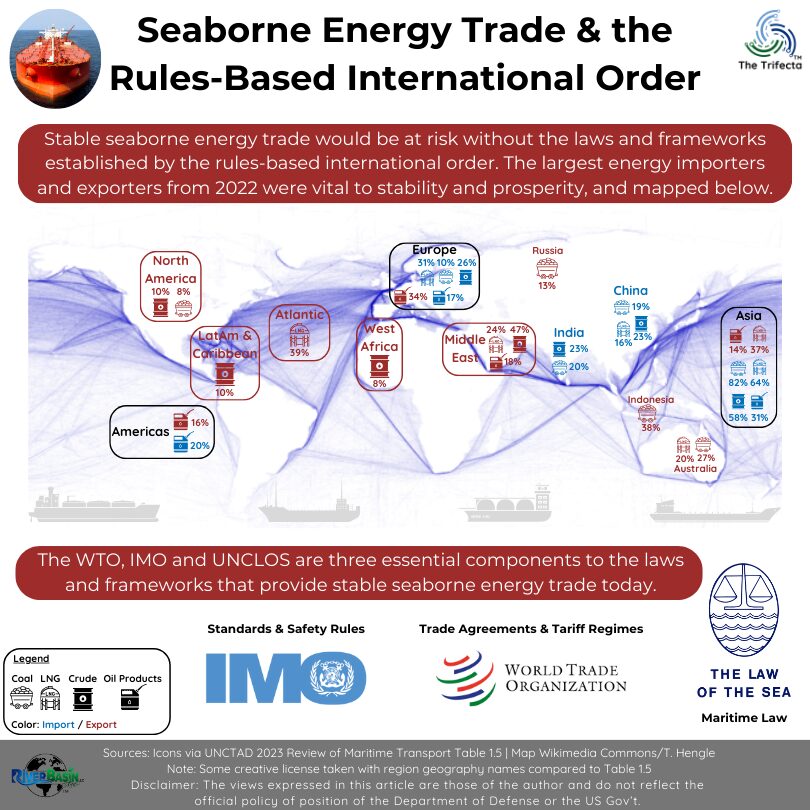

The rules-based international order promotes stability, prosperity, and cooperation among nations in the maritime domain. Three enablers of seaborne energy trade stand out:

World Trade Organization (WTO) – Trade agreements and tariff regimes can affect seaborne trade by influencing the flow of goods, tariffs on imports and exports, and market access. These agreements aim to promote fair competition, reduce trade barriers, and facilitate the smooth operation of global supply chains, benefiting seaborne trade and the overall economy.

United Nations Convention on the Law of the Sea (UNCLOS) – The foundation of international maritime law. It provides a legal framework for resolving disputes related to seaborne trade, territorial waters, and exclusive economic zones. Adherence to UNCLOS and other relevant treaties ensures disputes are settled peacefully and under established norms, fostering stability and predictability in maritime affairs.

International Maritime Organization (IMO) – Supports international cooperation in shipping, with a focus on safety and protecting the marine environment. It also sets standards for ship construction, equipment, and crew competency. Compliance with these rules ensures the safe and efficient movement of vessels engaged in seaborne trade, reducing the risk of accidents and environmental disasters.

Freedom of navigation is a critical enabler of seaborne energy trade.

Compliance with international norms and agreements is essential for upholding the principles of freedom of navigation, safety at sea, and fair access to global markets. Seaborne energy trade influences global energy prices, with fluctuations in shipping rates, vessel availability, and geopolitical tensions affecting supply chains and market dynamics.

Maritime chokepoints hold strategic significance and underscore the geopolitical implications of seaborne energy trade. Control over these critical waterways can exert influence over energy flows, regional stability, and international relations. If needed, coalitions of countries work together to safeguard maritime interests through naval presence, alliances, and diplomatic engagements.

Developing economies in Asia, with 60% of the world’s population, depend on seaborne energy imports.

With developing economies and about 60% of the world’s population, Asia’s need for energy comes as no surprise. How much of energy arrived via seaborne trade? The UN Conference on Trade and Development (UNCTAD) publishes an annual review of maritime transport. Calculated from the total 2022 global trade volume in a specific category, the top five importers were listed in Table 1.5 of the 2023 Review.

Asia topped the list in all four categories for energy imports: crude oil, oil products, coal, and LNG. Asia imported 58% of the total crude oil volume, 31% of the total oil products volume, 82% of the total coal volume, and 64% of the total LNG volume. While these data reflected seaborne trade only, the numbers were impressive.

The other top importers were Europe and the Americas. Some individual countries were listed as top importers if their portion was significant enough. For example, China alone imported over 22% of the total crude oil volume in 2022. Similarly, Japan imported over 18% of the total 2022 LNG volumes.

Seaborne energy exporters around the world enable importers to access diverse energy sources, help mitigate supply disruptions, and optimize their energy mix to meet domestic needs.

Table 1.5 of the 2023 Review also listed the top 5 exporters for the same categories. In contrast to the top importer list, Asia did not dominate every category for seaborne exporters. As expected, the Middle East/Gulf region held the leading position as the primary exporter of crude oil, with a 47% share of the total trade volume.

Europe secured the first spot for seaborne export of oil products with 34% by volume.

The top coal exporter, Indonesia, accounted for 38% of the total.

Last, the Atlantic region was #1 for LNG exports with 39%. (The definition of the “Atlantic” region is not clear geographically.) In this category, the Asia-Pacific region was a close second place with almost 37% of the LNG exports.

What is striking about the top five importers and exporters for these four fossil fuel categories is their global reach. Every continent (except Antarctica) appears as a “top 5” in at least one category. (Africa is the least represented continent and appears on only one list. West Africa is the fourth highest exporter of crude oil.)

This interconnectedness fosters economic interdependence, encourages international cooperation, and drives investments in maritime infrastructure and technology.

DOPSR 24-P-0602

Think About It…

- On which seaborne routes does your company depend the most?

- What alternatives exist for those routes? How costly would they be to use?

- How viable would your company be if seaborne shipping were not an option?

- Thinking about your company’s strategic plan, what seaborne route is most critical to achieve your goals?