Energy Tankers Through the Panama Canal

BLUF

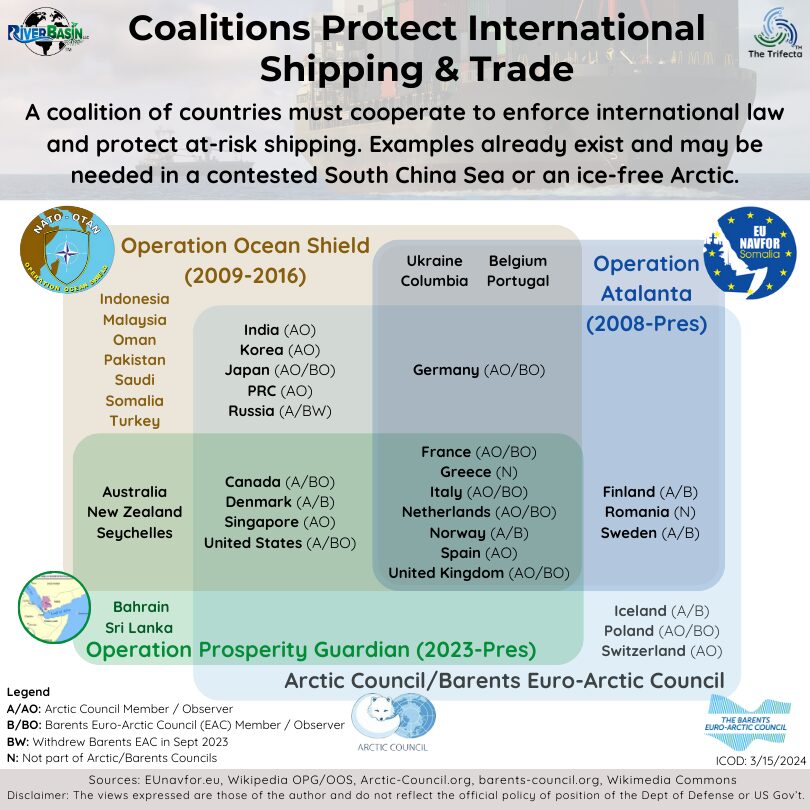

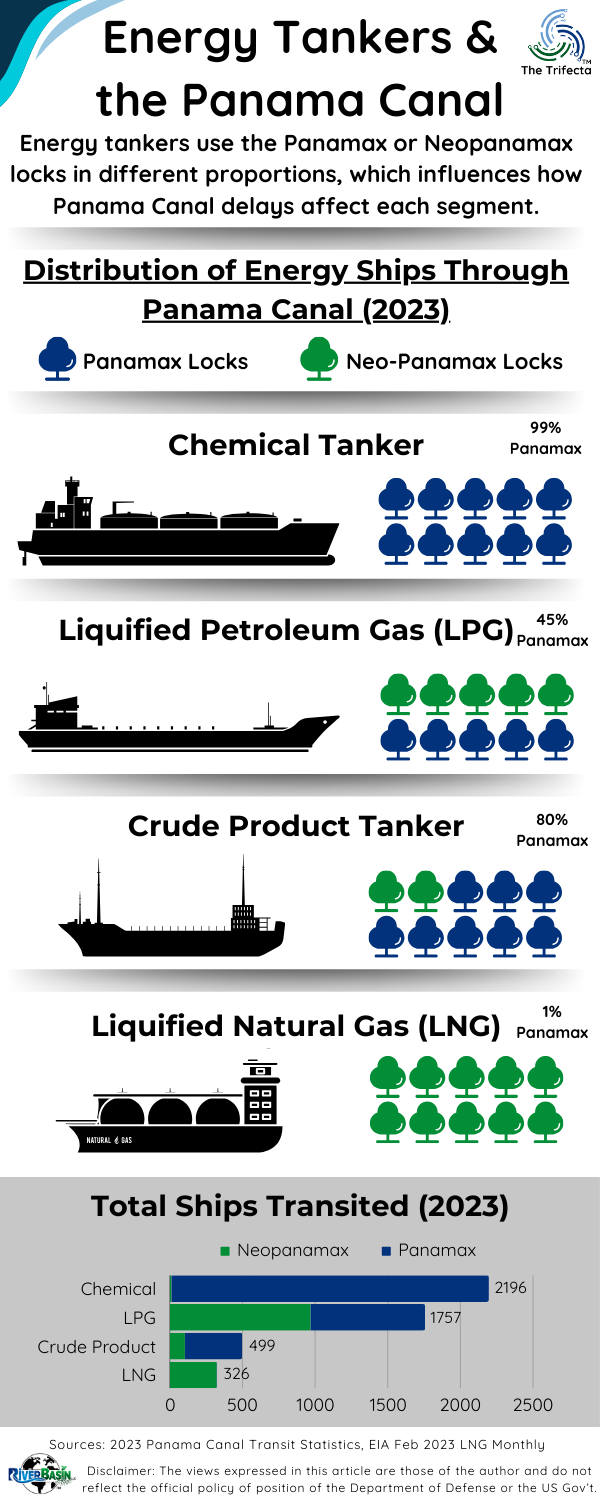

Depending on their cargo, energy tankers use the Panamax or Neopanamax locks in different proportions. This variation influences how Panama Canal delays affect each segment. Chemical tankers, for example, almost exclusively use the Panamax locks, while liquified natural gas (LNG) tankers almost exclusively use the Neopanamax locks.

Why does this matter?

The Panama Canal is crucial for energy security because of its role in facilitating the efficient transportation of energy resources between the Atlantic and Pacific Ocean. It serves as a key transit point for vessels carrying energy supplies, reducing shipping distances and transportation costs. This strategic waterway enables quicker and more cost-effective movement of energy resources, contributing to global energy stability.

Key Take-Aways

- Climate change is aggravating shipping reliability through the Panama Canal.

- Panama Canal shipping is particularly important to the US and China.

- The Panamax and Neopanamax locks can accommodate different energy tankers.

Disclaimers: The views expressed in this article are those of the author and do not reflect the official policy or position of the Department of Defense or the U.S. Government. The appearance of external hyperlinks does not constitute endorsement by the United States Department of Defense (DoD) of the linked websites. The DoD does not exercise any editorial, security or other control over the information you may find at these locations.

Climate change is aggravating shipping reliability through the Panama Canal.

For those not familiar, the Panama Canal has multiple sets of locks that enable ships to transit through the 50-mile (80 km) canal. The original canal was put into service in 1914 and consists of three sets of locks – the Miraflores locks (Pacific side), Pedro Miguel locks, and Gatun locks (Atlantic side). Gatun Lake is in the middle of the Panama Canal and provides the water to facilitate ship transits. Watch this short YouTube video to see what a ship transit looks like, courtesy of the Panama Canal Authority (ACP).

As ships increased in size to support globalized commerce, they eventually exceeded the capacity of the Panama Canal. In 2007, the “Third Set of Locks” project started. It took about nine years to complete and was inaugurated in June 2016.

Panamax vs Neopanamax Locks

Check out this infographic by DHL to understand the differences in ship capacities and capability to transit the Panama Canal. The ACP refers to the Panamax locks and the Neopanamax locks. Let’s examine both sets.

Panamax Locks: These locks can accommodate ships with 5,000 TEUs (twenty-foot equivalent units) arranged 10 containers wide. Locomotives on either side of the lock pull ships through. The locks associated with Panamax are Miraflores (Pacific side), Pedro Miguel and Gatun (Atlantic side)

Neopanamax Locks: These locks can accommodate ships with 14,000 TEUs arranged 13 containers wide. Ships are guided through the lock by tugboats on each end of the ship. The expanded canal locks were inaugurated on June 26, 2016. Locks associated with Neopanamax are Cocoli (Pacific side) and Agua Clara locks (Atlantic side).

COSCO Shipping Panama completed the inaugural transit of the Neopanamax locks in June 2016. In FY2022, the Neopanamax locks accommodated 53% of the total Panama Canal tons that transited the waterway.

Drought challenges Panama Canal operations

Disruptions to Panama Canal operations threaten global supply chains. Drought is the primary culprit and led the ACP to reduce transit slots during 2023, which is not the first time operations were reduced.

Ships are required to have a reservation to transit the canal, regardless of the locks they intend to use. Complexity increases during drought conditions when the ACP reduces transit slots. Decreases in transit slots can cause a backlog of ships waiting to transit. In November 2023, ACP announced special auctions to offer additional transit slots for the Panamax locks in an effort to help alleviate the backlog. One chemical tanker reportedly paid $1,100,100 for an auction slot.

In 2024, ACP announced an unexpected increase in transit slots because of successful water saving measures and restrictions. While the increase provides welcomed relief, overall restrictions are expected to continue through 2024.

Panama Canal shipping is particularly important to the US and China.

The US and China both depend on maritime transport through the Panama Canal. In 2019, 66 percent of the cargo traffic transiting the Canal began or ended its journey at a US port. Cargo from or destined to China made up 13 percent of canal traffic.

Shipping between China and the US east coast (e.g., Miami, Florida) is six days faster traveling through the Panama Canal versus the Suez Canal. Cost and time savings accrue quickly given the volume of traffic on the water. In-depth analysis is required to explore more implications, exceeding this post’s scope.

Looking at FY2023 data, 50% of the Pacific-to-Atlantic cargo movement was associated with the Asia origin route (not specifically China). When traveling from the Atlantic to the Pacific, 76% of cargo movement was linked to the east coast of the US.

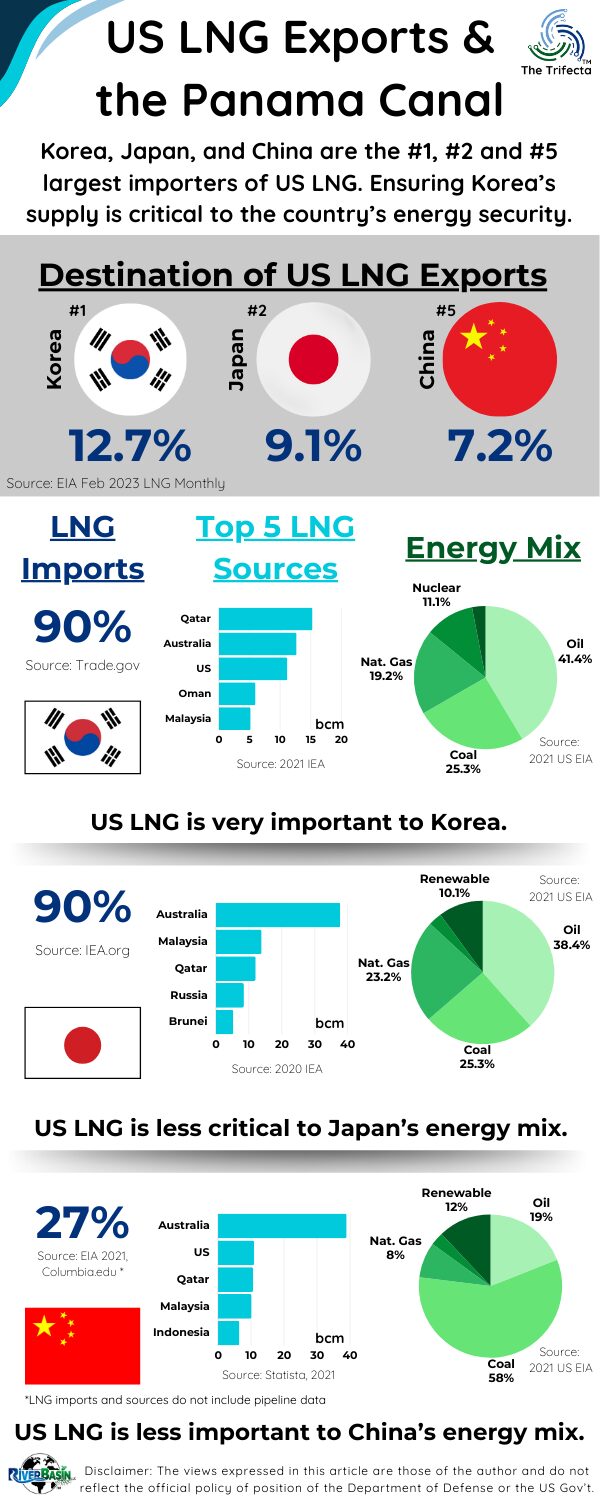

Completion of the Neopanamax locks in 2016 helped transform the United States into a gas exporter by enabling more cost competitive liquified natural gas (LNG) to flow from the US Gulf Coast to Asia. Between February 2016 and December 2022, 32.9% of all domestically produced LNG was delivered to 8 countries in the East Asia and Pacific region, according to EIA data. We will investigate this more below.

The Panamax and Neopanamax locks can accommodate different energy tankers.

From a broad perspective, supply chain disruptions because of Panama Canal operational reductions affect businesses that depend on timely supplies. Delays in shipping force companies to rely on in-place stocks or storage. Depending on the feedstock or component in question, this may be impractical or only a short-term solution.

Analyzing transits through the Panama Canal across all market segments, 74% transit the Panamax locks. When considering a smaller subset of transits – those directly related to energy supplies – the portion passing through the Panamax locks drops to about 70%. However, differentiation between market segments in 2023 offers a different perspective.

In 2023, chemical tankers transited the Panamax locks 99% of the time and comprised 18% of the total passing ships. Similarly, 79% of crude product tankers transited through the Panamax locks.

Liquified petroleum gas (LPG) through the Panama Canal

LPG tankers were split nearly even between the two sets of locks – 45% Panamax and 55% Neopanamax – and LPG was the highest volume of liquified cargo shipped through the Canal. According to the Energy Information Agency (EIA), transit delays for Very Large Gas Carriers (VLGC) caused LPG shipping rates to reach record highs.

With 45% of LPG carriers using the Panamax locks, some were eligible for the November 2023 special auctions. Even if an auction slot is secured, the additional cost of delays plus an auction slot alters the economics of the voyage. For example, in November 2023, Japan’s Eneos Group paid nearly $4 million for an auction slot to enable transit for the Sunny Bright, a 50,000 dry weight LPG carrier.

But, liquified natural gas (LNG) ships 99% through the Neopanamax locks.

In contrast to the other energy market segments, 99% of the liquified natural gas (LNG) ships used the Neopanamax locks, as the LNG ships are too big for the Panamax locks. In December 2023, the ACP changed the rules for reservation slots to prioritize full container vessels. This left the LNG vessels with few options but to seek an auction slot, increasing their overall cost (like LPG mentioned above).

Think About It…

- How are your shipments split between the Panamax locks and the Neopanamax locks?

- What affects has the Panama drought had on your business and bottom line?

- Which of your customers are most affected by Panama Canal delays?

- What parts of your company’s value chain are most directly affected by Panama Canal reservation slot reductions?

- At what point will the canal delays be long enough to warrant re-routing your tankers?

- How else is your business mitigating the delays at the Panama Canal?

DOPSR 24-P-0389